Welcome to the June issue of the Mutual Fund Observer!

It’s a grand month, whose start was marked by the 165th commencement ceremony celebrating Augustana’s graduates. The college was born in 1860, an expression of longing and ambition. Swedish immigrants in the Midwest – and there were a lot of them – wanted to provide their children with a better life, which, to them, meant a good education. At the same time, they didn’t want their children to forget their homeland and its proud traditions.

So, they made a college. Modeled after the great universities in northern Europe, Augustana became an expression of faith: in the welcome that America gave its new citizens, in the country’s endless promise, in the power of education, and in the wonder of their children. This year, 555 souls representing 68 majors, 26 states, and 23 countries joined the storied roster of Augie grads.

Much has changed at the College, so very much. But those smiles, those expressions of incandescent pride and joy, that expression of family and faith and hope, never have.

It’s a grand month, whose close will be marked by Chip and me arriving in Augustana’s ancestral homeland for the first time. From June 20 – July 3, she and I will be traveling via planes, buses, ferries, and trains – from Stockholm to Uppsala, thence to Oslo, Flam, and Bergen. That has two implications. First, we’ll have a July issue finished at mid-month, with the faithful Raychelle launching on July 1st for us (and you). Second, if you’ve got cool and out-of-the-way spots for us to peer into – cool cafes? Neat markets? Iconic shipwrecks – let us know! We’ll share pictures and credit.

In this month’s issue …

Don Glickstein makes his debut with “Stories over Stats,” advocating for a narrative-driven approach to investing that prioritizes manager communication and downside protection over complex analytics. Like me, Don is a UMass grad. Unlike me, he’s also a former journalist and award-winning author of After Yorktown: The Final Struggle for American Independence (2015).

Don Glickstein makes his debut with “Stories over Stats,” advocating for a narrative-driven approach to investing that prioritizes manager communication and downside protection over complex analytics. Like me, Don is a UMass grad. Unlike me, he’s also a former journalist and award-winning author of After Yorktown: The Final Struggle for American Independence (2015).

Drawing an analogy to baseball’s preference for “unicorn” players with compelling stories, Glickstein systematically rebuilt his portfolio around four key questions: Does the fund maintain cash reserves? How did it handle inflation? What’s its downside protection? Do managers communicate effectively with shareholders? His rebalancing led him from fully invested funds to managers like Marshfield Concentrated Opportunity (28% cash) and FPA Queens Road Small Cap Value, emphasizing the importance of direct manager communication and defensive positioning.

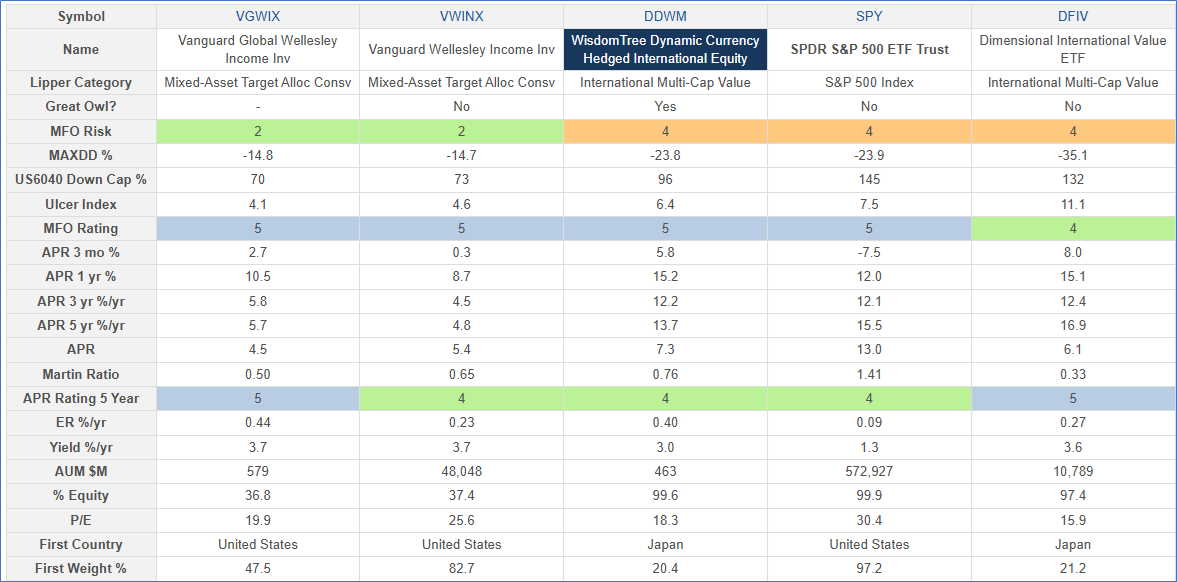

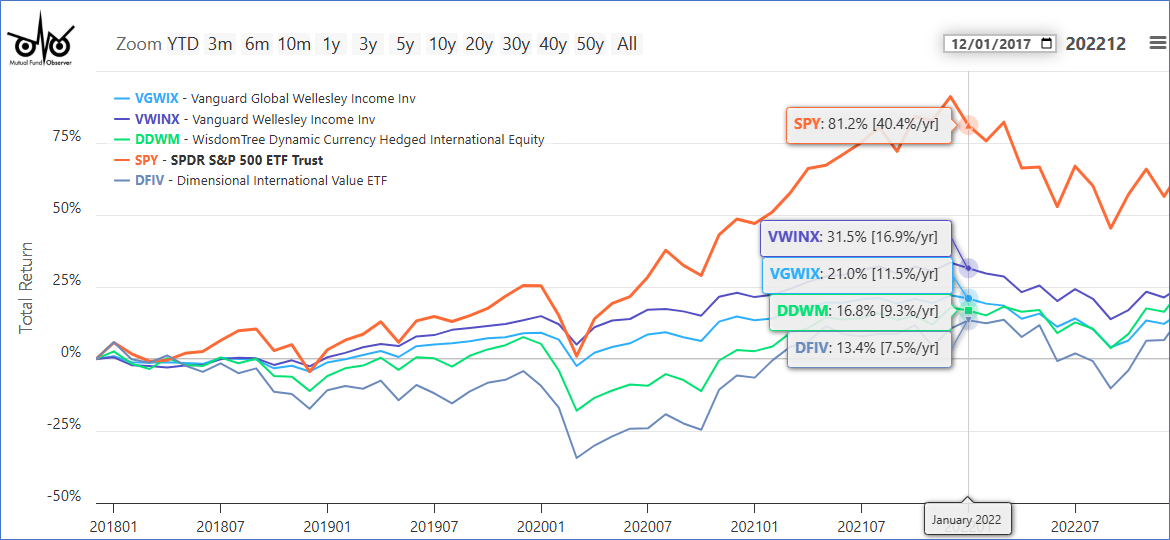

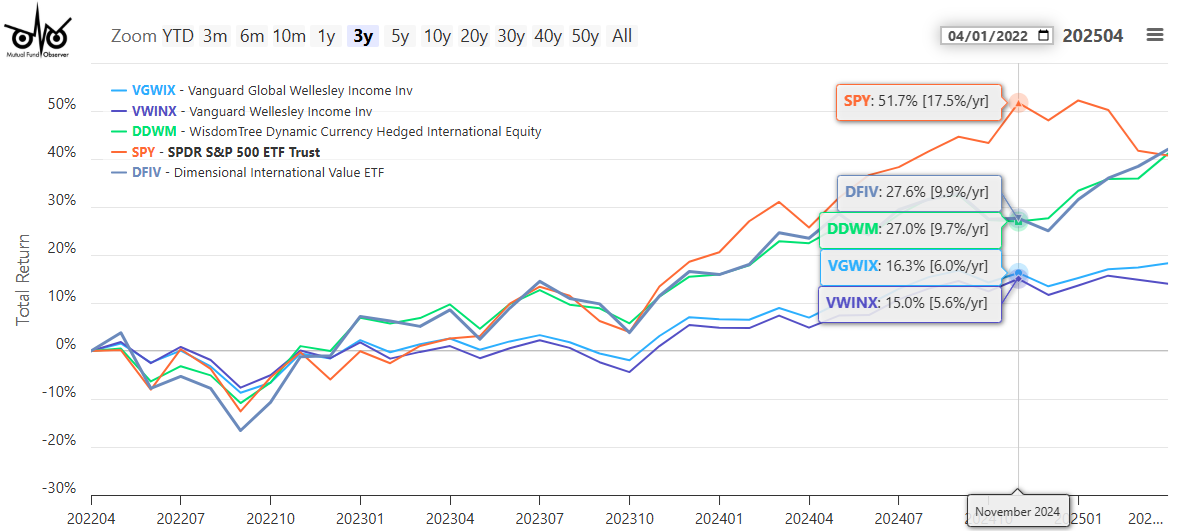

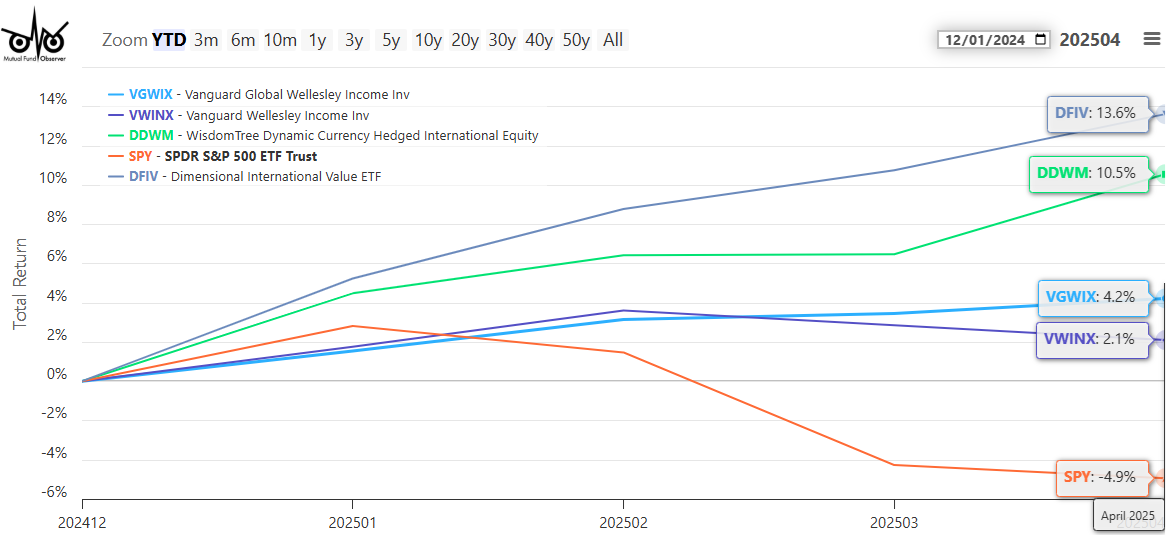

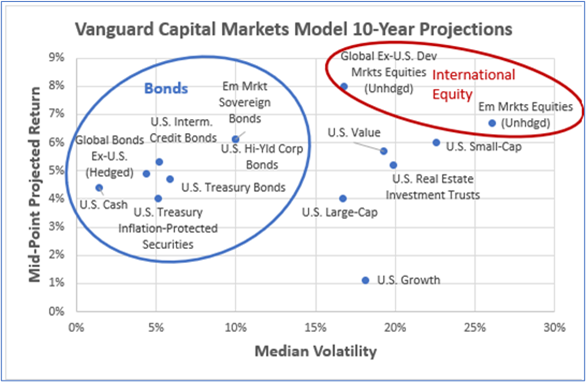

Lynn Bolin continues his practical guidance with two complementary pieces addressing current market uncertainties. In “Investing Internationally for the Timid Investor,” he recommends Vanguard Global Wellesley Income Fund (VGWIX) for conservative investors seeking international exposure without the volatility of pure equity funds. For less timid investors, he suggests WisdomTree Dynamic Currency Hedged International Equity Fund (DDWM), noting that international equities are currently outperforming expensive US markets.

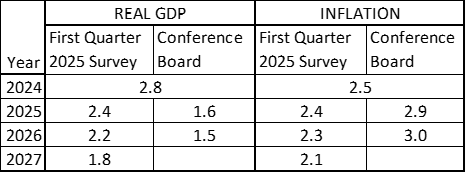

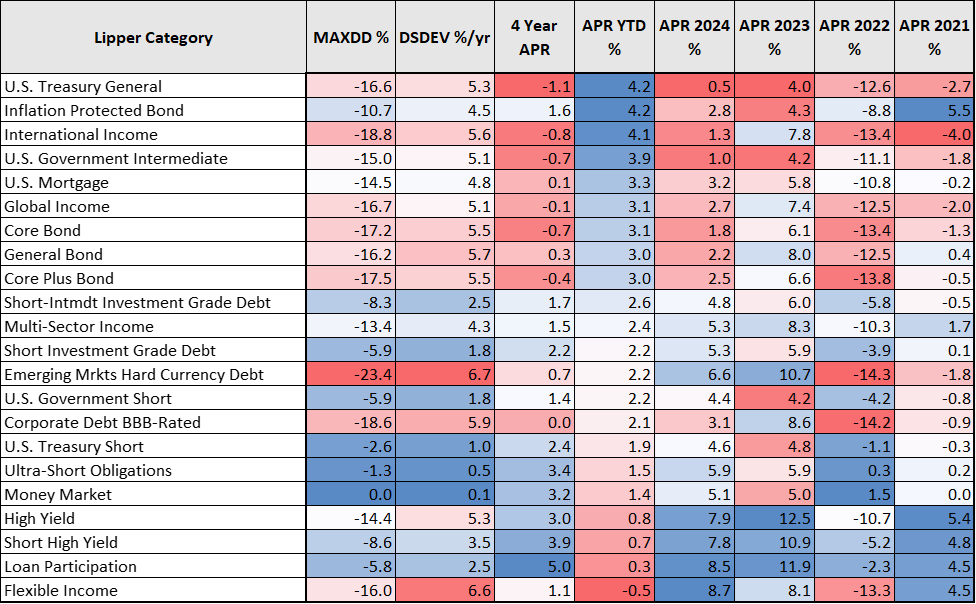

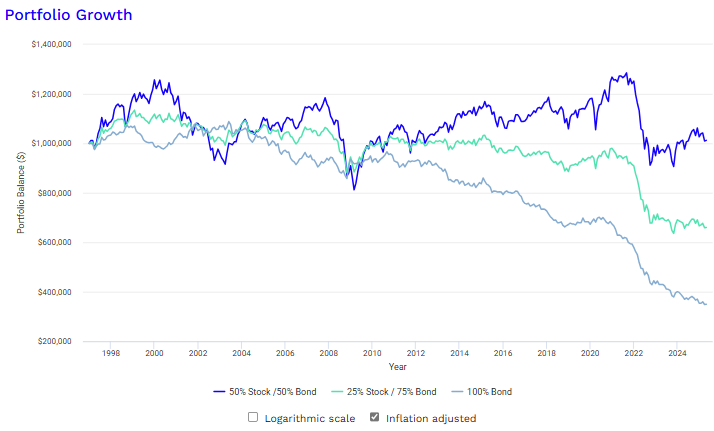

His second essay, “Best Laid Plans of Mice and Men,” provides a sobering assessment of the current economic environment, citing Federal Reserve Chairman Powell’s warnings about “more volatile inflation” and “more frequent supply shocks.” Bolin reduces his stock allocation from 57% to 50%, emphasizing shorter-duration bonds and inflation-protected securities as tariff policies and rising deficits create unprecedented uncertainty.

All three pieces reflect a shared philosophy of defensive positioning in uncertain times. Both authors prioritize downside protection, favor managers who maintain cash reserves, and emphasize the importance of clear communication from fund managers. Bolin’s international diversification recommendations align with Glickstein’s search for funds with defensive characteristics, while both writers advocate for simpler, story-driven approaches over complex analytics during periods of heightened market volatility.

The collective message is one of prudent caution: reduce risk, diversify globally, seek defensive managers, and focus on preservation of capital in an environment where “this time is incredibly different.”

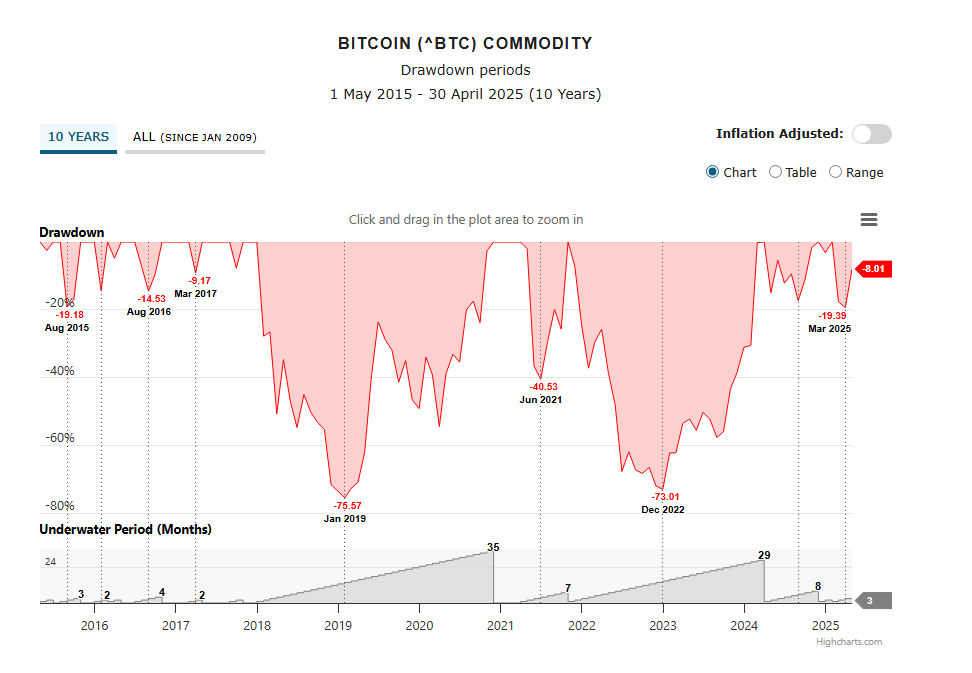

This caution is especially warranted when “Something wicked this way comes,” our analysis of two potentially disastrous changes in the financial markets. The US Department of Labor has denounced decisions made during the Biden administration to restrict the use of cryptocurrencies in retirement accounts. On May 28, 2025, that restriction effectively ended. The second development is largely driven by industry greed: single-stock ETFs, leveraged or reverse leveraged, were a tiny and unnecessary niche product. As we looked at May’s SEC filings, it became clear that something like a hundred new single-stock offerings are surging toward you. Collectively, the government and the industry have embraced a vision of the market as a casino, and of speculation as investing. We walk through the risks with you.

Often, I think my writing is “purely okay.” I’m actually half-proud of the writing in this one. I hope you like it.

Finally, The Shadow shares “Briefly Noted” word of the torrent of fund-to-ETF conversions that’s rushing over the industry (RiverNorth Core? That one surprised me), along with other developments, including new CEOs at two major independent fund firms.

A peace built on quicksand, a rally built on TACOs

One of the most famous unattributed descriptions in the 20th century described the events following the Treaty of Versailles (1919) as “a peace built on quicksand.” At base, the Treaty was incredibly, fundamentally flawed. A vindictive document written by bitter old men. Marshal Ferdinand Foch, a key French military leader during World War One, famously said of the Treaty of Versailles: “This is not a peace. It is an armistice for twenty years.”

The generations that followed paid the price for their idiocy. The rise of the Nazi movement and the fall of a series of democratic governments, the German turn toward cults of personality and vengeance, were largely product of those failed negotiations. Twenty years later, World War Two erupted in Europe. Historians ultimately judged it, with its 75 million deaths, to be “the final battle of World War One.”

As we write this issue, the S&P500 sits with a gain of 1% for the year (through 5/30/2025), a ferocious rebound from its low point in the year: a loss of 19%. The question is, does this rally suggest that the coast is clear?

We suspect not. It is, to coin a phrase, a rally built on TACOs. TACO is the latest meme in the investing world, and it stands for Trump Always Chickens Out. Since inauguration day, the stock market has lurched downward every time Mr. Trump announces, sometimes on the spur of the moment, a new, tightened, or extended tariff. And the stock market has lurched upward every time Mr. Trump … well, chickens out, and removes, loosens, or pauses a tariff. Mr. Trump has made over 50 separate trade and tariff announcements in just over four months (“What is TACO trade and how ‘Trump chickening out’ helps investors,” Business Standard, 5/29/2025). The New York Times summarizes it this way: “The tongue-in-cheek term adopted by some analysts and commentators describes how markets tumble on President Trump’s tariff threats, only to rebound when he relents” (5/27/2025).

The term was coined by Robert Armstrong of The Financial Times (5/2/2025), and it reportedly infuriates Mr. Trump. It is also a balm to investors looking for a reason to trade.

Two things you need to know:

-

Trump has always chickened out. His reputation as a master negotiator was created by a book he didn’t write, Trump: The Art of the Deal. The book was written by Tony Schwartz who regrets participating in the myth-making, but also notes that Mr. Trump operated with “a stunning level of superficial knowledge and plain ignorance,” which is attributed to an extremely short attention span and the inability to focus on anything beyond self-aggrandizement for more than a few minutes (Jane Mayer, “Donald Trump’s ghostwriter tell all,” The New Yorker, 7/18/2016). Others who have actually engaged Mr. Trump in negotiations conclude “he’s not a good negotiator.” A striking example is The Art of the Deal itself: Mr. Schwartz was given 50% of the $500,000 advance and almost 50% of the royalties, and he got his name on the cover in the same line and same font as Trump.

Most ghostwriters for books like Trump’s are paid a flat fee in the $30,000–$100,000 range, rarely receive royalties, and almost never get their name on the cover. How hard was that to achieve? “He basically just agreed,” according to Mr. Schwartz (Michael Kruse, “He Pretty Much Gave In to Whatever They Asked For,” Politico, 6/1/2018). Mr. Kruse’s article documents a long and stable pattern: Mr. Trump chickens out.

-

But you can’t count on it.

While stock investors hum a merry tune and consumer confidence measures perk, many of the people responsible for the underlying economy are hunkering down. The Leuthold Group reports (5/7/2025) that the stocks of economically sensitive companies (think “trucking”) are withering:

Out of necessity, bear market rallies and the first leg of a new advance look nearly identical; if they didn’t, the game would be too easy. However, the action (or lack of it) within the most economically sensitive groups would seem to support our bearish take.

Hedge fund manager Doug Kass, who has a suspiciously good record at forecasting short-term market movements, just announced that “I view less than 5% upside compared to 10%-15% downside. This is an increasingly unattractive ratio of nearly three to one” (5/31/2025). His reasoning:

Political and geopolitical polarization and competition will probably translate into less centrism and, in turn, a reduced concern for deficits. This will create structural uncertainties, fiscal sloppiness, and worldwide imprudence. It will also create the possibility that bond markets ‘disanchor’ … l see valuations and consensus expectations for economic and corporate profit growth inflated, so look for the soft data to weaken into the hard data as the housing market slows and the vulnerability of the middle class is revealed.

And in the background, a largely supine cohort of congressional Republicans happily pushing along a tax cut that will add trillions to the deficit. All of the major credit rating agencies have now stripped the US of its top-tier rating, and increasing numbers of international (aka “foreign”) investors are losing interest in part-ownership of America.

But you knew all that already. For our purpose, the message remains the same: risk-conscious, multi-asset, broad diversification away from just the largest US stocks and Treasury bonds.

If you’re so rich, why aren’t you smart?

We wrote last month about the peculiar, and peculiarly American, fantasy that equates being filthy rich with being smart. The original essay is posted on LinkedIn and has been read by a fair number of folks (and, I hope, by a number of fair folks).

Almost immediately after our publication, a desperate new story began circulating:

Elon Musk wandered into a random Harvard University math classroom, was challenged by the (certainly liberal) professor … and then Elon CRUSHED the Crimson. Here’s the lede to one such post:

A Harvard Professor Mocked Elon Musk as ‘Rich But Dumb’—Then Musk Solved an ‘Unsolveable’ Math Problem in 2 MINUTES! 😱 The Crowd Went SILENT!

Ummm … the crowd went SILENT! Because there was no crowd. No classroom. No Musk at Harvard. No Musk ownin’ the libs. There were pictures – check out the 1960s vintage chalkboard above, apparently that’s all that Harvard can afford these days – generated by AI.

Which, I suppose, might have been able to solve the math problem (Laerke Christensen, “No proof Musk solved ‘unsolvable’ math problem at Harvard,” Snopes.com, 5/30/2025). Christensen’s article did have a nice poke at DOGE, with which Musk estimated he could easily trim a couple of trillions from the US budget. That appears not to have occurred (CBS News, 4/28/2025).

Our essay’s original argument remains: getting to be ultra-rich generally requires two vast blind spots, which facilitate the risk-taking and ruthlessness needed to get that rich, but those same blind spots create tragic misjudgments.

Changes in Snowball’s portfolio

Just FYI. I very, very rarely second-guess myself. For most of my funds, my holding period is measured in decades (see, for example, FPA Crescent, which I first acquired around the turn of the century). In May, however, I made two moves.

Move one: I added PIMCO Inflation-Response Multi-Asset to my retirement account, selling down CREF Social Choice to fund it. At base, the fund invests in assets that rise with inflation. Those include inflation-linked bonds, commodities, currencies, REITs, and precious metals. PIMCO’s pitch:

Unlike conventional stocks and bonds, inflation-related assets tend to have a positive correlation, or tendency to move in lockstep, with inflation. Including them in a portfolio may therefore enhance diversification while helping to hedge inflation risk.

Morningstar praises the management team for a deep bench and sharp execution. It’s a fairly small position but represents an attempt to hedge as I enter the … umm, second half of my career. The fund has returned about 8.1% annually over the past five years, and risk-return measures (Sharpe, Sortino, Martin, Ulcer Index) are well ahead of its “flexible portfolio” peers. We’ll look into it more in our July issue.

Move two: looking to eliminate T Rowe Price Spectrum Income. Spectrum Income is a fund-of-Price-funds that I’ve owned forever. I have never liked savings accounts, and so my “cash” tends to be split between ultra-short funds and Spectrum Income. Spectrum holds shares of 20 other fixed-income funds. What it doesn’t hold is exposure to dividend-paying equities, which was a long-time distinction of the fund. Price announced in April the elimination of the equity fund that was designed to add a bit of capital appreciation to a fund that otherwise lacked distinction.

The problem is that my embedded capital gains in the fund, owing to its decent performance (4.1% over 15 years with both a little more upside and a little more downside than its peers) and my decades-long holding, are substantial. I still need to work that through before acting.

Thanks, as ever …

To the faithful few who keep the lights on and our spirits up: the good folks at S&F Investment Advisors, Wilson, Greg, William, William, Stephen, Brian, David, Doug, and Altaf.

Special thanks this month to five friends. Sharon both made a generous contribution and arranged a matching grant from her employer, Debbie made an equally generous contribution in honor of her late husband, and my long-time best friend Nick Burnett, Jeroen of Anchorage (thank you, sir, we try hard and we’re glad it helps!), Thomas from Idaho (which I haven’t visited) and Stephen of Albuquerque (which I have visited and thought was amazing in both people and place.

We’ll wave from the Nordic nations.